Credit Savvy is urging Australians to start actively managing their credit reputation in the new financial year.

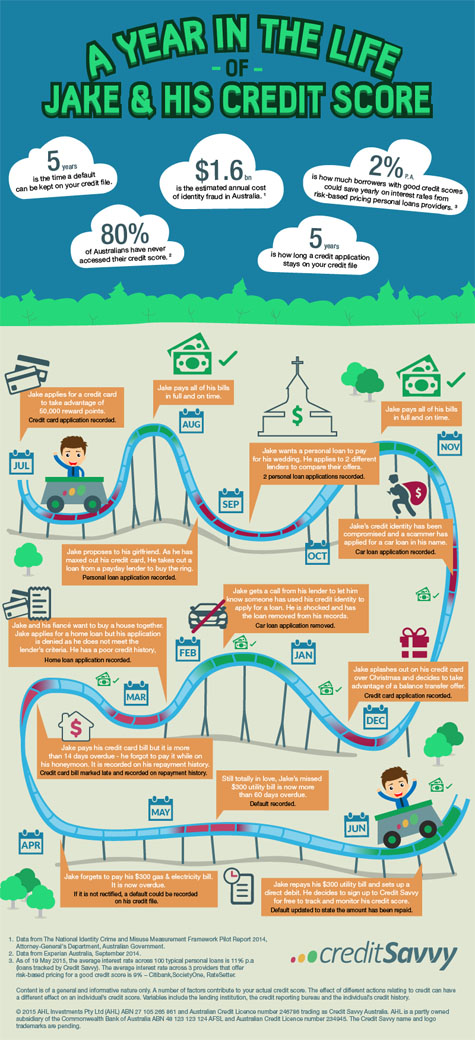

The consumer credit score advocate has released an infographic that visualises how an individual’s credit reputation can be affected by a range of contributing factors – including some they might never have considered.

“Consumers are generally aware they need to pay their bills on time, but they might not realise that making too many credit applications in a short time frame could negatively impact their credit reputation,” said Dirk Hofman, Managing Director at Credit Savvy.

“We’ve created this infographic to help Australians understand the importance of tracking their credit score over time and taking positive steps to manage their credit reputation”.

“We expect that in the coming financial year we will be seeing lenders opting in to comprehensive credit reporting. For the average Australian, this means that more information about their credit arrangements and credit history can be shared between lenders, which makes active management of your credit reputation a priority”.

Credit Savvy provides consumers with free, ongoing access to their Experian credit score, as well as credit alerts to notify them of key changes to their Experian credit file information.

“One of the best ways of proactively monitoring your credit reputation is to track your credit score and check your credit file regularly. That way you can take steps to correct any errors and also understand what actions might be affecting your credit score,” Mr Hofman explained.

Credit Savvy’s EOFY Tips

• Pay your bills & loan repayments on time

• Don't apply for too much credit in a short time frame

• Stay away from specialty finance providers like payday lenders

• Monitor your credit score over time

• Check your credit file for errors that may be unfairly impacting your credit reputation

• Be patient – it takes time to improve your credit health

• Sign-up to www.CreditSavvy.com.au to track your credit score for free

ABOUT CREDIT SAVY

Credit Savvy is a new digital initiative that aims to help Australians make savvy financial decisions by understanding their credit status and how credit works. Credit Savvy provides consumers with free access to their credit score, credit file information, credit monitoring & practical tools. It works with global credit provider Experian.

Agree (0)

Agree (0) Disagree (

Disagree (

__small.png)