Forget the size of Australia’s national debt – which, by the way, is one of the lowest in the OECD – and various political opinions on government expenditure waste. Perhaps every Australian should look at their own household first.

Research from ahm health insurance shows that Australians waste $1,597 each a year on products and services they don’t use – throwing away $19.4 billion.

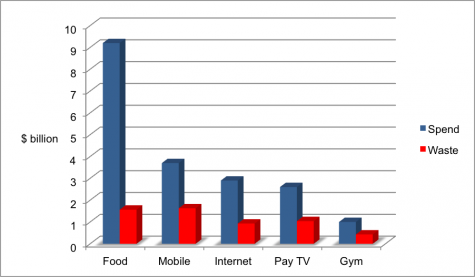

The ahm research shows that mobile phone contracts (44%) and gyms memberships (43%) have the biggest wastage, with Australians, on average, not using half of the services they pay for. This equates to more than $218 and $263 a year per person respectively.

Internet bills and TV subscriptions are equally wasteful, with an average spend of $236 per year on data never used - almost a third (32%) of the total annual bill - and over $400 a year on unwatched TV channels.

We’re a little better with food, spending $9.2 billion and throwing out about ‘only’ 17% in value – or $1.6 billion every year.

Chart: What Australians spend v what Australians waste - private money

But ahm says that since the global financial crisis, a group of savvy entrepreneurs and spenders has emerged with nearly half researching online (44%) before making a purchasing decision and 15% regularly switching suppliers to get the best deal possible. They look much more closely at what they are buying, cut out the bells and whistles and pay for what they actually want to use.

One obvious illustration of this is flights. Airlines and online booking engines have made air travel much more competitive. As an example, a flight booked this week from Melbourne to Perth at the end of September attracted fares ranging from $150 to $257 at the low end through to $224 to $460 for the highest economy fare. For $150, there are no headsets, food, drink and only carry-on luggage – but if that’s all that’s needed, why pay more?

According to 'futurist' and social researcher, Neer Korn, savvy life spenders are more selective in their spending, minimising waste in order to obtain the best possible deal.

“Whilst some are more dedicated than others, everyone’s keen to find products, services and packages that suit their specific needs.”

Neer Korn believes that avoiding waste and getting the best deal possible is a new “status symbol for Australian consumers”.

“Many consumers are still driven by spontaneity and impulse purchasing. By searching a little harder and finding flexible products best suited to the individual, they can all avoid excess waste and spend more on the things they want.”

Neer Korn's tips on how to be a savvy life spender

1. Others’ experiences

Turn to others who have recently been through a similar decision-making process or may be experts and well versed in the area of purchase. Ask friends or family, as well as utilising consumer forums and review sites

2. Comparisons

Seek out websites that offer comparisons between products and services, so you can compare apples with apples and select the best product or service for your needs.

3. Bargaining

It's no longer seen as shameful, in fact 'if you don't ask you don't get', so try bargaining in all areas of shopping.

4. Personalisation

Search out products and services that suit your specific needs and lifestyle to avoid paying for things that won't be used.

5. Catalogues

Stop thinking of catalogues as junk mail and use them to seek out specials, large and small. Read through them, circle what's attractive to you, then decide where to shop based on what is on offer.

__small.png)