How much money do Aussie children earn, spend and save?

A survey of more than 1,000 parents of 4-15 year olds conducted by the Commonwealth Bank earlier this year showed that almost 80% of parents give their children pocket money.

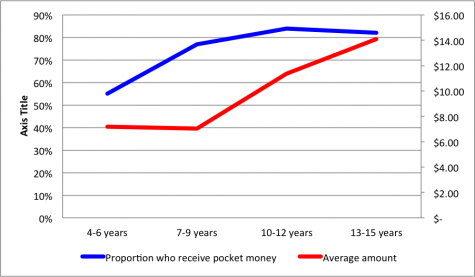

Pocket money starts, on average, just after a child turns 6 with the amount depending on the child’s age. Generally, the older a child gets, the more likely they are to receive pocket money and more of it as shown in the chart below.

Surprisingly, when looking at how pocket money has increased over the years, children today are not necessarily financially better off than their parents. When the parents in the survey were children, they received an average of $3.19 per week. This is $6.98 less than what their children are receiving now, which means the average increase in pocket money per annum is 3.7%, below the inflation rate over the past 30 years, which averages 4.2%.

More than four in five parents believe that children do not understand the value of money unless they earn it, which is why pocket money is largely given in exchange for work. To receive pocket money, 71% of children are expected to do some household chores, such as tidying their bedroom or washing the dishes – even though 92% of parents believe that those chores should be done without the recompense of pocket money.

But it’s not just pocket money that’s flooding in. More than two-thirds of children look to additional sources outside their pocket money allocation, the most popular being through presents (45%) the tooth fairy (27%), or as a reward for good marks at school (13%). In 2012, 4-15 year olds earned an average of $276.18 from additional sources outside pocket money! And, just as salaries and wages are not equal between the genders in many industries, it’s boys who earn more than girls – all-up about $40 in one year.

But experts, including the Commonwealth Bank’s David Cohen and financial adviser Jeremy Cabral who has six tips to develop good savings habits, say pocket money is good way to start good financial habits.

“I believe it is beneficial to introduce children to situations where they are dealing with real money – regardless of how small the amount – and a great way to do this is by slowly introducing them to pocket money. By doing this you can teach your children how to budget, how to save towards something they really want, the value of earning money, and also the benefits of saving versus spending. A financially literate generation of children will inevitably lead to a more prosperous society, so these are invaluable life skills,” Mr Cohen said.

__small.png)