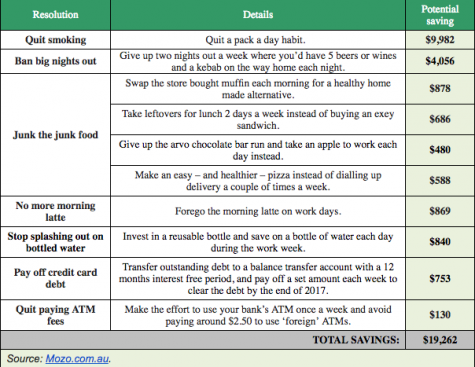

Sticking to New Year’s resolutions in 2017 could result in thousands of dollars worth of savings over the year, according to an analysis of the cost of ten common bad habits by Mozo.com.au.

The financial comparison site says the biggest savings are on offer for those who ditch ciggies and boozey nights out, with savings close to $10,000 for quitting a pack a day smoking habit and over $4,000 for giving up two nights out a week.

"Aussies who ditch their vices in 2017 could save enough money to buy a car if they stick to their guns throughout the year, with bad habits like takeaway meals, boozey nights, and even paying ATM fees adding up to a huge $19,262," says Mozo Director Kirsty Lamont.

"Smoking is by far the most expensive bad habit and it’s set to get even more expensive in 2017 with a big excise increase taking the annual cost for a pack a day smoker to nearly $10,000."

"Big nights out can add up to $4,000 over the year if you’re having five beers or wines a couple of times a week, and stopping off for a kebab on the way home."

Mozo says outside of the big ticket vices, those seeking out alternatives during the working week to unhealthy snacks and takeaway meals could save around $2,600 over the year, with further savings for those willing to give up lattes and bottled water.

"A little pre-planning goes a long way when it comes to your wallet and waistline with a quick and relatively healthy DIY pizza nearly 3 times cheaper than the home delivery alternative, not to mention a saving of around 1,000 kilojoules! Taking the leftovers to lunch a few times a week will save an extra $686 over the working year," says Lamont.

"Likewise, doing a spot of Sunday baking and swapping cafe muffins for a healthier homemade option could save you $878 over the year if you have a muffin a day habit, and close to 130,000 kilojoules over the year!"

"We’re also gulping down significant savings with daily lattes and bottled water – giving up one coffee a day will save you nearly $900 over the working year, while using a reuseable water bottle will stop you splashing out $840 on bottles of water each day."

Mozo’s analysis shows ditching bad financial habits in 2017 can also lead to big savings.

"Clearing credit card debt could save around $750 by transferring your outstanding debt to a balance transfer card with at least a 12-month interest free period, and then paying off a set amount each month," says Lamont.

"And if you’ve made a bad habit of paying ATM fees to withdraw cash once a week, you could save an easy $130 over the year by using your bank’s ATMs instead."

Those looking to pay off their credit card debt in the new year can compare 117 zero per cent balance transfer credit cards online using Mozo’s balance transfer comparison tool at https://mozo.com.au/credit-cards.

New Year’s Resolution Savings

Notes on calculations: Credit card savings are calculated using average credit card debt of $4,342 per cardholder, based on latest RBA data for credit balances accruing interest and latest Roy Morgan data on number of credit card holders with weekly repayments of $84 (not including annual fee).

ABOUT THE EXPERT

Mozo compares 1,800 products from 200 banking, insurance and energy providers to help over 300,000 Australians find a better deal each month via its award winning comparison tools and calculators. Mozo is proud to partner with some of the country's biggest online publishers, making it one of the most visited comparison sites in Australia.

Agree (0)

Agree (0) Disagree (

Disagree (

__small.png)